There are a number of ways to transfer your money online. With the digital boom, online money transfer has become the easiest way of transferring money from one bank to another without any hassle. You can opt for online bank transfer methods through net banking such as NEFT, RTGS and IMPS. Or you can transfer money through UPI or digital wallets.

1) National Electronic Fund Transfer: NEFT is the simplest and most liked form of money transfer from one bank to another. It is known to be the most cost-effective and convenient online money transfer option for various reasons. NEFT is available on internet banking and mobile banking services provided by most banks in India. The transactions are processed in batches and the funds are settled based on the cut-off time specified by the RBI. To make any NEFT transaction, you just need two things – first, the account number and second, the IFSC code of the account in which you need to transfer the money.

2) Real Time Gross Settlement: RTGS is almost similar to NEFT but the minimum payment and how it credits to the destination account differs. There is no upper cap on the amount. Under RTGS, the funds are settled in real-time without any delay. The bank of the person to whom the money is transferred gets 30 minutes to credit it to his/her account. Each transaction is processed on instruction by instruction basis, making it faster and efficient. Effective 14 December, RTGS fund transfer is available for customer and inter-bank transactions round the clock, except for the interval between ‘end-of-day’ and ‘start-of-day’ processes.

Also Read: Top 7 investment options in India to boost wealth

3) Immediate Payment Service: IMPS is an instant fund transfer service and it can be used anytime. In order to avoid frauds, the cap on transaction limit is set very low. For IMPS transfer, you just need to know the destination account holder’s IMPS id (MMID) and his/her mobile number. Most banks allow IMPS through their internet banking and mobile banking platform.

4) Unified Payments Interface: UPI is a real-time payment system that allows transactions to be done through any smartphone. It allows users to transfer money from one bank account to the other without the need of bank details. In order to send and receive funds, UPI uses a Virtual Payment Address (VPA), and the transactions can be done 24/7. UPI-enabled apps allow the transfers up to Rs 1 lakh.

5) Digital wallets: Many digital wallets have been introduced to the Indian market to facilitate digital transactions. Digital wallets are not only popular and useful for being an optional method for online transactions but also for the ease and convenience of transferring money to another user or bank account.

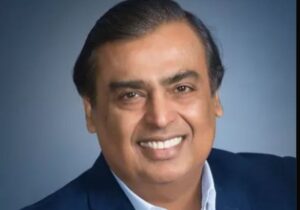

India’s Billionaire Elite: Forbes Top 10 Richest Indians of 2025

PNB scraps minimum balance penalty for all savings accounts, follows SBI & Canara Bank’s lead

HDB Financial Services IPO: HDFC Bank’s NBFC arm set for June 25-27 launch